san mateo tax collector property tax

If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax bill. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

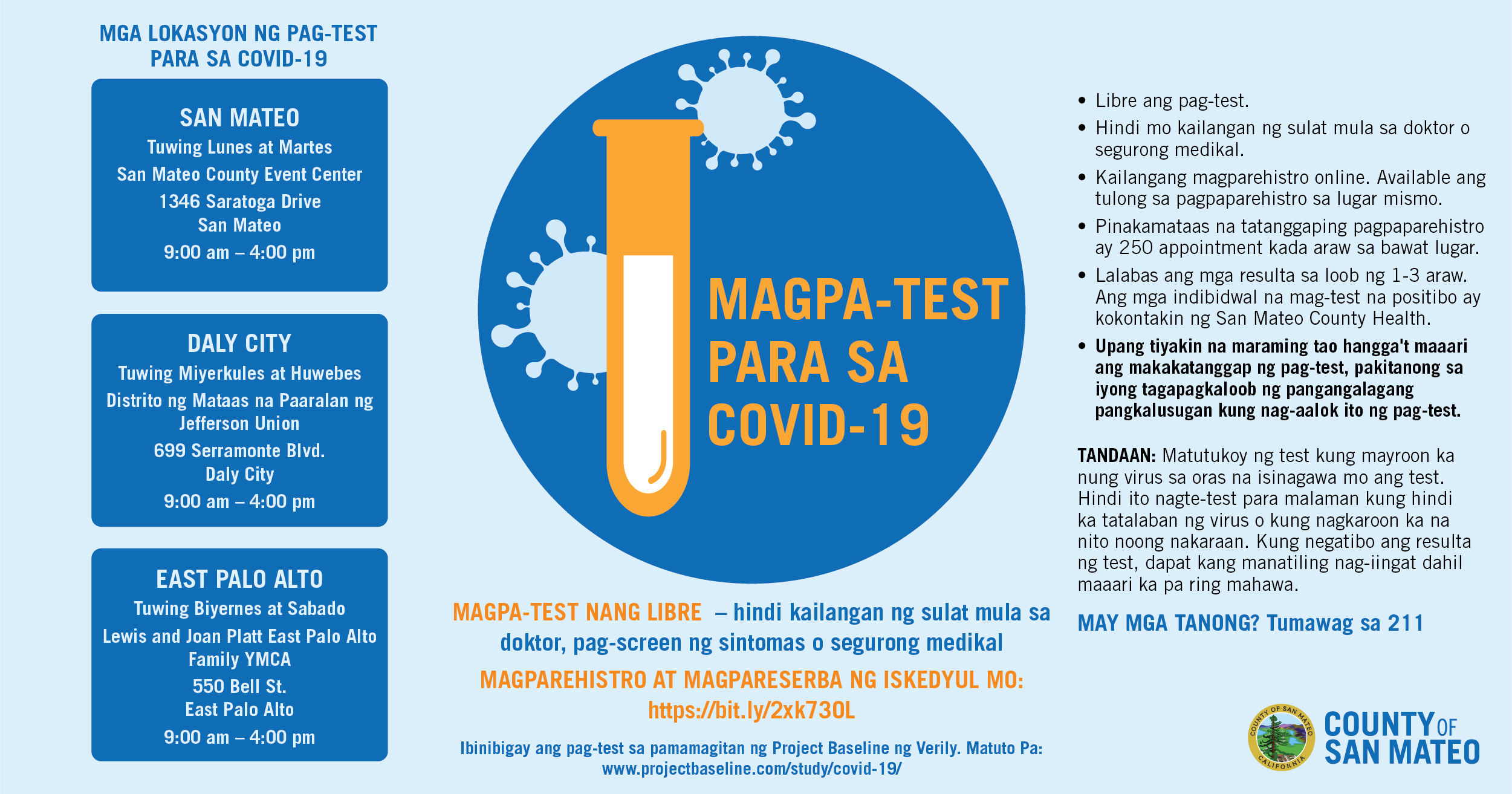

Get Free Testing Fliers And Social Media Graphics County Of San Mateo Ca

NSMCSD SEWER FEE 650 991-8084.

. Rebecca Greene - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123 Phone. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. You also may pay your taxes online by ECheck or Credit Card.

There is no charge for filing for the Homeowner Exemption. The Office of the Treasurer Tax Collector is open from 8. The San Mateo County property tax rate is 056 of assessed fair market value making property taxes in this California county one of the highest in the country.

San Mateo Uhsd Bond. Appointed in 2004 and first elected in 2005 Cisneros has used his. The law provides property tax relief to property owners if the value of their property falls below its assessed value.

Property Tax Bills and Refunds San Mateo County Assessor-County Clerk-Recorder Elections - ACRE. BURSCHDST MEASL PARTX 650 259-3812. Payment plans may not be started online.

The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. Look Up an Address in San Mateo County Today. Request Full and Updated Property Records.

Announcements footer toggle 2019 2022 Grant Street Group. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. The 202122 Secured Property Tax bills are now available to view and pay online.

Total Ad Valorem Taxes 114430000. FEDCANPDES STORM FEE 650 363-4100. Welcome to the San Benito County Tax Collectors Website.

Search and Pay Business License. 13 characters - no dashes. NSMCSD SEWER FEE 650 991-8084.

Box 7426 San Francisco CA 94120-7426. However you have until 500 pm. Of December 10th to make your payment before a 10 penalty is added to your.

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. Property information is maintained by the Assessors Office. The median property tax on a 78480000 house is 580752 in California.

Current value on January 1. Office of the Treasurer Tax Collector PO. City and County of San Francisco.

You may purchase duplicate tax bills for 1 at any Tax Collectors office. Please note only our downtown branch office can accept cash payments. Levying authority Phone Number Amount.

Treasurer-Tax Collector San Diego County Admin. Nature of Question Tax Rates. FEDCANPDES STORM FEE 650 363-4100.

If you have questions or would like to correct any of the information regarding your parcel please contact the Assessors Office at 909 387-8307. The 1st installment is due and payable on November 1. The factored base year value typically the purchase price adjusted annually for inflation not to exceed 2 percent per year or.

The median property tax on a 78480000 house is 824040 in the United States. Business Tax Quarterly Payment Due Dec 12. Generally property is assessed at the lesser of two values.

San Mateo County collects on average 056 of a propertys assessed fair market value as property tax. New property owners will automatically receive an exemption application in the mail. In fulfilling these services the Division assures that the County complies with necessary legal.

View a property tax bill and make property taxes payments including paying online by mail. Monday - Friday 800 am. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800.

San Mateo County Tax Collector PO. Levying authority Phone Number Amount. Pay Transient Occupancy Tax.

2019 2022 Grant Street Group. Taxpayers Bill of Rights. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County.

He serves as the Citys banker and Chief Investment Officer managing all tax and revenue collection for San Francisco. 858 694-2922 MS O-53. Ad Get Reliable Tax Records for Any San Mateo County Property.

Business Personal Property Tax Payment Oct 31. San Mateo County secured property tax bill is payable in two installments. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Levying authority Phone Number Amount. Uncover Available Property Tax Data By Searching Any Address. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check. Search and Pay Property Tax. Direct Charges and Special Assessments.

Nature of Question Tax. Click here for Property Tax Look-up. San Mateo County has one of the highest median property taxes in the United States and is ranked 45th of the 3143.

858 694-2901 Fax. The 20212022 Annual Secured property tax roll is closed.

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

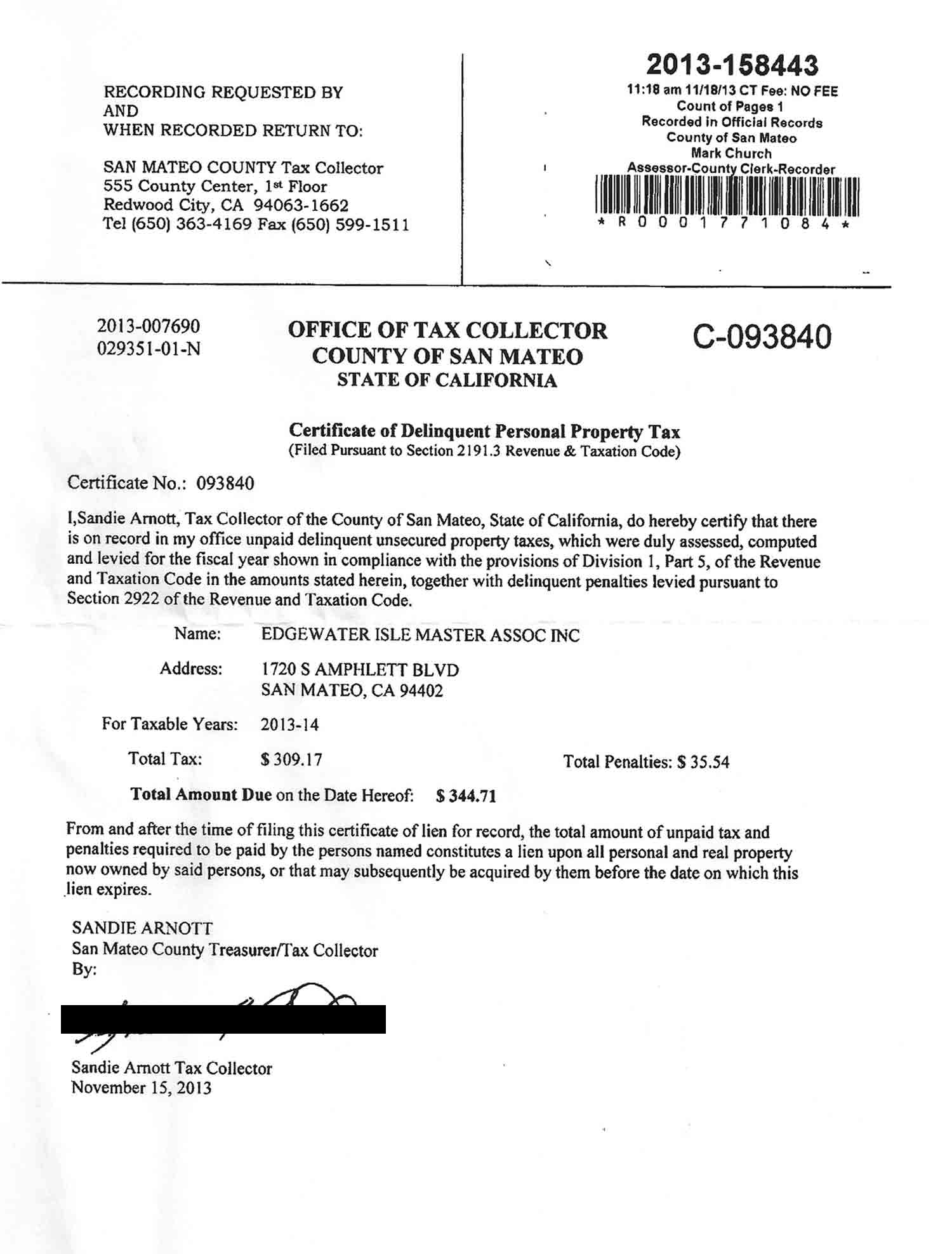

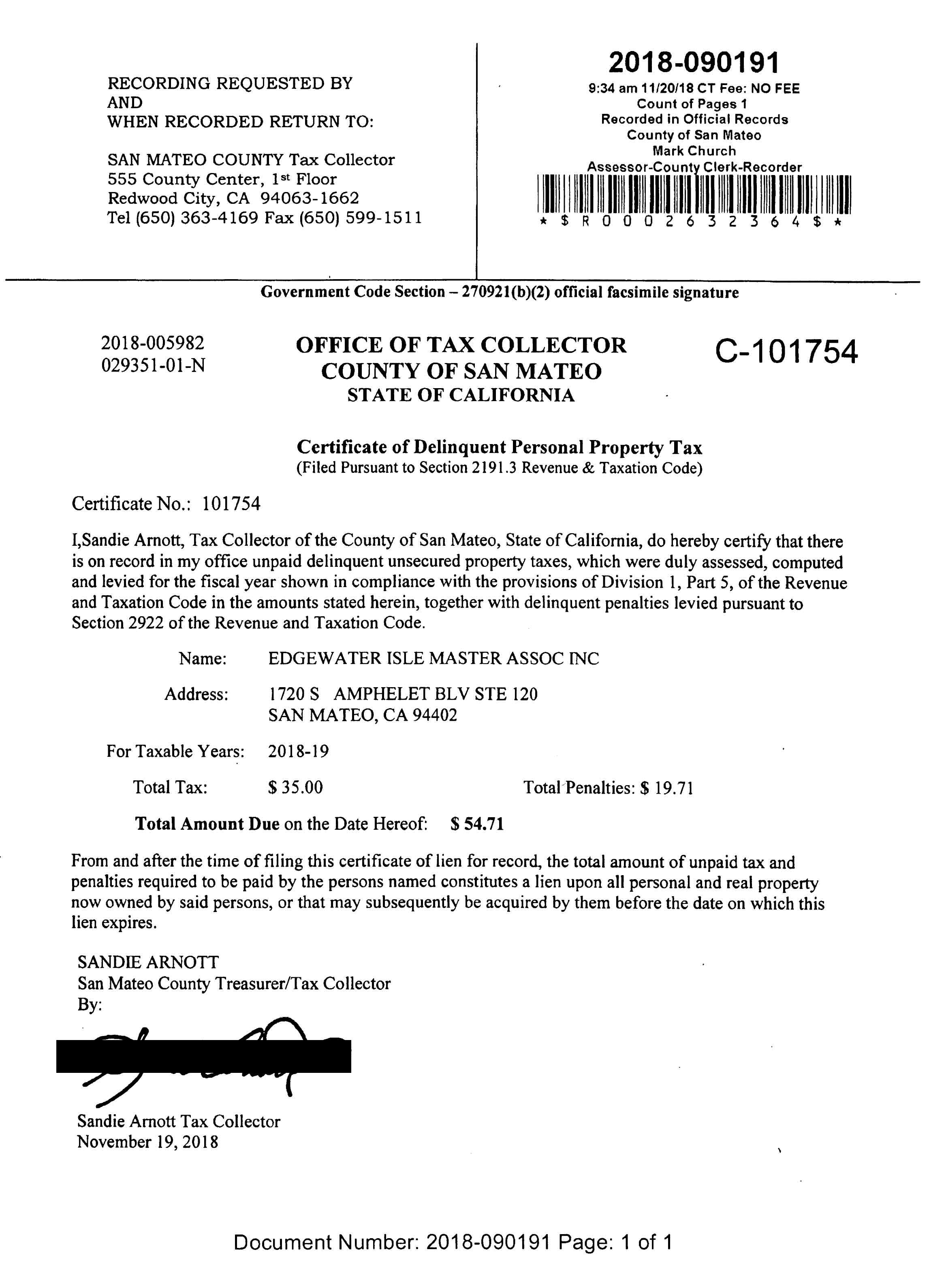

San Mateo County Issues Liens Against Master Association

County Of San Mateo California Selects Taxsys Pittsburgh Pa Grant Street Group

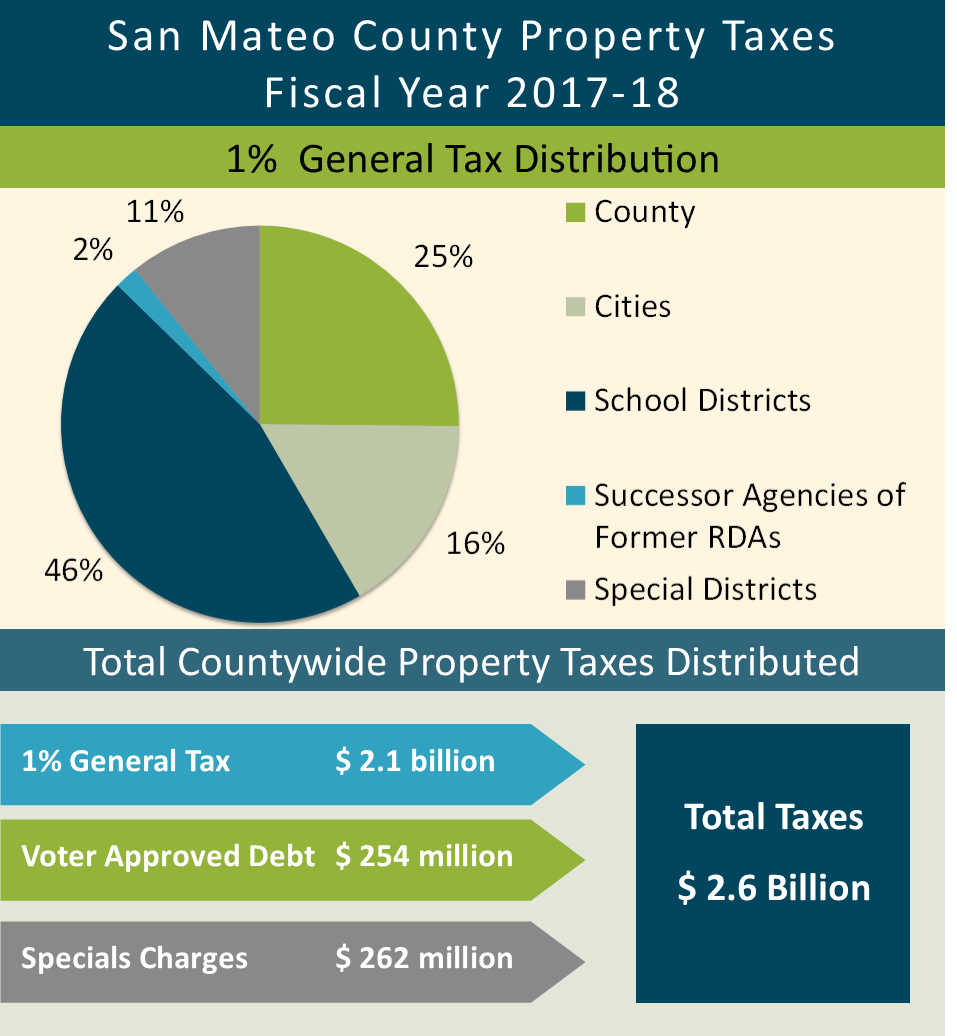

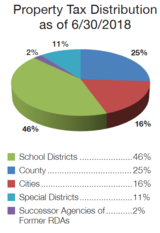

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

San Mateo County Harbor District County Of San Mateo Ca

San Mateo County Issues Liens Against Master Association

Pay Property Taxes Online County Of San Mateo Papergov

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca

San Mateo County Issues Liens Against Master Association

Where Do My Taxes Go County Of San Mateo Ca

Online Services San Mateo County Assessor County Clerk Recorder Elections Acre